Tim Mulligan

Browse all of our reports, featuring our analysts' expert insights and analysis of audience segmentation, emerging trends and technologies, value chains, market shares, predictions and more – backed by our proprietary survey data and bespoke models & forecasts. Become a subscriber to get new ones every month, or just pick one to get started.

Jack Ryan and the trinity of awareness, viewing, and fandom

Post-Pandemic Programming Surviving and Thriving in the Recession

Is HBO Max about to disrupt Netflix domestically with relevant scripted drama?

Does Apple and augmented reality equal Apple TV+ 2.0?

MIDiA’s UK video consumer deep dive Q2 2020 report

Q2 2020 UK Video Consumer Deep Dive

A brutal Q2 pressures Disney to erode the theatrical release window

The end of the pay-TV era: AT&T gets behind HBO Max

Recovery Economics: What the post-lockdown world looks like for TV

Netflix Q2 2020 earnings: Lockdown revenue windfall but performance expected to fall

D2C Big Bang Impact, H1 2020 English-speaking Markets

Recovery Economics Post-Lockdown TV

Welcome to the world of digital autarky

Netflix $17 billion budget staves off Disney and HBO Max competition

Device sales key to Apple TV+ ROI

Recovery Economics Outlook for Music, Games, Video & Sports

Is streaming making it harder and more expensive for consumers to access video content?

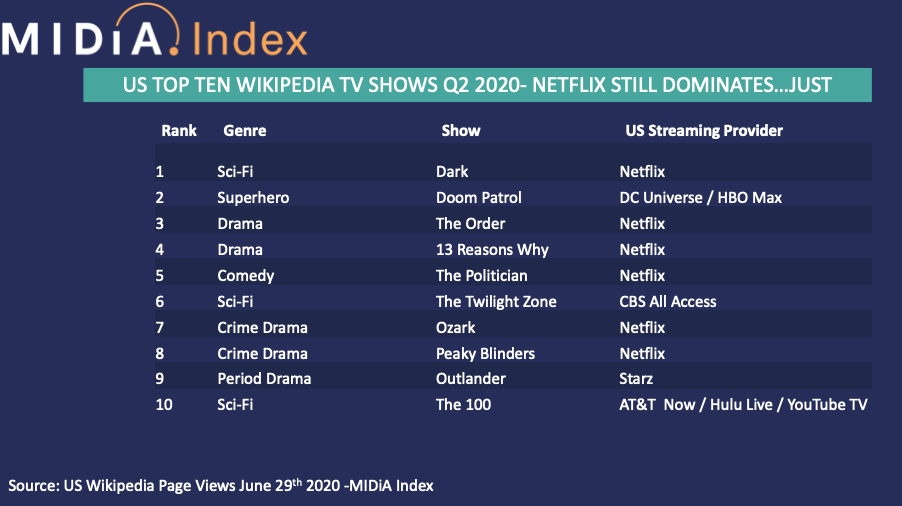

Q2 2020 TV Show Demand Asia-Pacific