Karol Severin

Browse all of our reports, featuring our analysts' expert insights and analysis of audience segmentation, emerging trends and technologies, value chains, market shares, predictions and more – backed by our proprietary survey data and bespoke models & forecasts. Become a subscriber to get new ones every month, or just pick one to get started.

Can Xbox All Access help Microsoft tip the games console market share in its favour?

Tech Majors Market Shares Q2 2018 A Tale of Mixed Fortunes

UK Gamer Profile Digital Entertainment Natives

Why Sony Can (And Should) Play The Walled Garden Game

Tech Majors Market Shares Q1 2018 Advertising and Subscriptions Power Growth

Quick Take: How E-sports Video Partnerships Help Tech Majors In The Sports Wars

Profiling Chinese and Indian Gamers

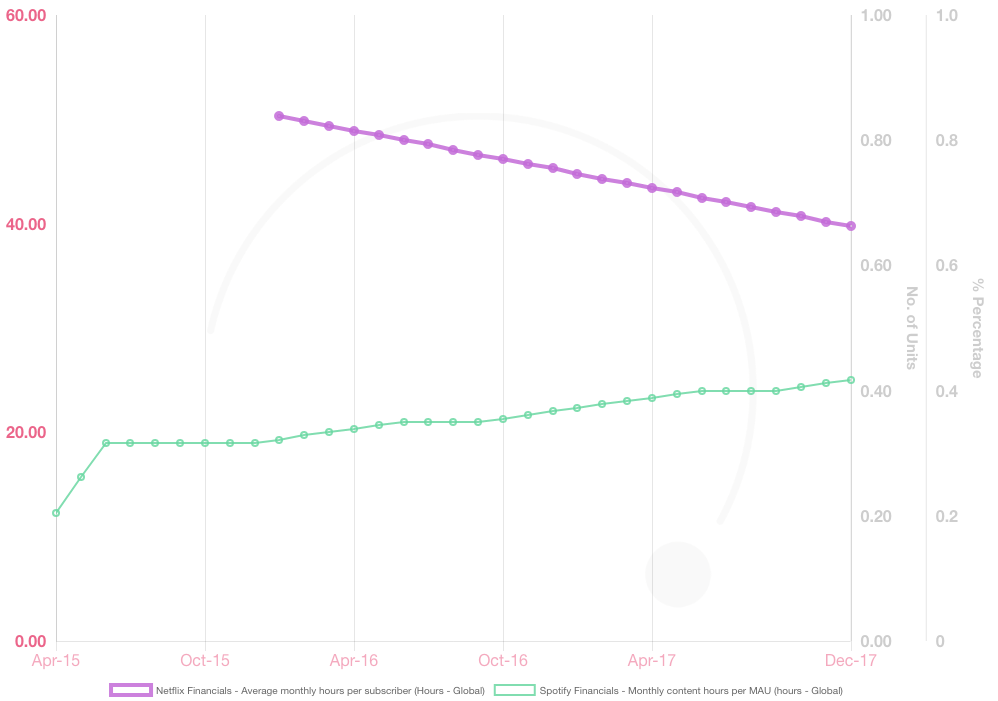

Spotify and Netflix Are Experiencing Opposite User Engagement Trends

Could Magic Leap’s Future End Up More B2B than B2C?

Could Hatch Be Rovio’s Answer To Satiating Shareholders In The Long Term?

Binge-viewing Gamers Competition Spikes As Peak Attention Nears

Which TV Genres Have The Highest Paid Conversion Rates Among Fans?

Fandom Overlap – Cannibalisation Risks For Games And SVOD Releases

Gaming And Video Fandom Overlap Cannibalisation Risks For Games And SVOD Releases

Twitch To Start Live Streaming Minor League Basketball

Facebook Launches App For Under 13s