Global music industry enters new phase of recalibration, says MIDiA

1st July 2025, London - The global music industry is navigating a crucial period of recalibration, as outlined in MIDiA Research’s recently published report “Global Music Forecasts 2025-2032.” This comprehensive report is an in-depth analysis of a market experiencing changing growth patterns, increasing complexity, and geographical shifts.

Following a strong 2023 for recorded music revenue, 2024 marked a year of tempered growth. Global recorded music revenues increased by a modest 4.5%, slightly short of MIDiA’s 2024 bear scenario forecasts.

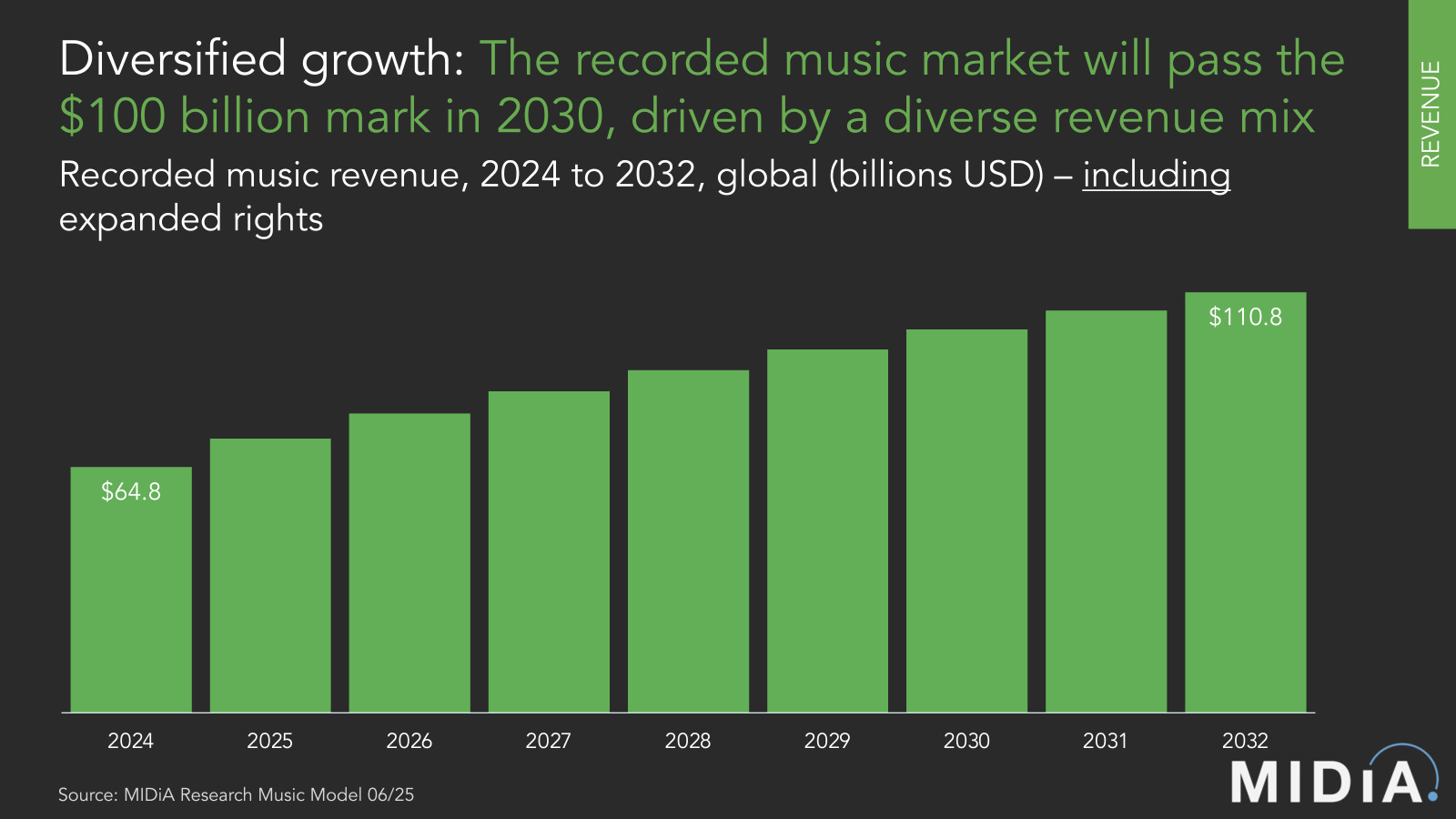

Inclusive of expanded rights, global recorded music revenues reached $64.8 billion in retail terms and $35.9 billion in label trade terms in 2024. Growth rates fell well below the average of the past three years.

The ad-supported segment had a weak year in 2024, with revenues remaining flat compared to 2023. The segment faced multiple headwinds, including the migration of users to premium subscriptions in Western markets and increased competition for ad spend.

Subscriber additions remained strong in 2024 –with only a slight drop from a strong 2023, resulting in 818.3 million music subscribers globally. The Global South continues to grow its role, dominating subscriber growth as four-fifths of all subscriber growth in 2024 came from outside of North America and Europe. China, now the world’s fourth-largest recorded music market, is on course to become the second-largest by 2032, signalling a shift in the industry’s centre of gravity toward the global south.

Despite the near-term slowdown, the long-term outlook remains positive. Retail revenues will reach $110.8 billion by 2032, surpassing the $100 billion mark in 2030. Label trade revenues are expected to reach $58.2 billion by 2032, with retail values outpacing due to DSPs capturing a larger share of consumer spending.

According to the report, authored by Mark Mulligan, Tatiana Cirisano, Perry Gresham, and Mark Qi, streaming continues to dominate, accounting for 73% of all 2024 revenues, and this share will increase to 83% by 2032. Streaming will contribute $19.3 billion in additional trade revenues by 2032, powered by user growth in emerging markets and ARPU gains in established ones.

Featured Report

Ad-supported music market shares Spotify ascending

Ad-supported streaming has always occupied a unique and slightly contentious place in the music industry ecosystem. On the one hand, ad-supported still represents an effective way to reach consumers at scale, creating a wider subscriber acquisition funnel.

Find out more…“As streaming user growth slows in the West, getting music consumers to spend more is going to be central to revenue growth. The question is whether consumers have an appetite for spending that matches the industry’s expectations, which is why continued diversification of income will be so important for long term market growth.” – Mark Mulligan, Managing Director and Senior Music Analyst at MIDiA Research

“Format competition is a strong factor in this year's ad-supported streaming forecasts – from short-form video drawing music video users, to podcasts vying for ad spend on the audio side. As entertainment formats increasingly compete for the same consumer attention in the same spaces, the future will be shaped in part by music's ability to cut through and stand out.” – Tatiana Cirisano, VP of Music Strategy at MIDiA Research

“Over the coming years, streaming services will continue to target Subscriber ARPU (average revenue per user) to fuel revenue growth in established markets, via formalised price increases and new ‘Supremium’ tiers. There will be a tension between these tactics and adding new subscribers. In the West, a choice between subscriber growth and ARPU growth looms large.” Perry Gresham, Head of Data at MIDiA Research

The full report is linked here. For any questions or to arrange an interview, please reach: Tsion Tadesse, PR and Communications Executive, MIDiA Research via Press@midiaresearch.com or tsion@midiaresearch.com.

Methodology notes:

This report draws on MIDiA Research’s proprietary data, industry interviews, and historical market trends to forecast the global music industry’s growth through 2032. The analysis combines quantitative modelling with qualitative insights from MIDiA’s analysts and senior industry stakeholders. Market sizing estimates are based on a blend of primary research, company filings, and third-party data sources, normalised for consistency and accuracy. All figures are in USD unless otherwise stated. Further details on methodology can be found in the report and associated data file.

About MIDiA Research

MIDiA Research is the global leading authority in music, the creator economy, and cross-entertainment. Our subscriptions, data tools, and strategy consulting bring clarity to complex industries by providing support and expertise. Our trusted data and powerful insights help make confident and impactful decisions. By leveraging multi-country consumer data, forecasts, market shares, and the insights from our creator panel, we empower clients to think differently, revealing unique solutions they did not even know existed.

With our deep understanding of both the business and culture of entertainment, we work with entertainment companies to navigate tough industry challenges. Driven by a passion for discovering new knowledge, insights, and solutions, our team nurtures creativity and innovation to consistently deliver dependable results.

The discussion around this post has not yet got started, be the first to add an opinion.