MIDiA Research 2025-2032 global music forecasts | Recalibration

We are pleased to announce the release of MIDiA’s annual music forecasts report. This is always a labour of love and takes a bit longer than some other entities’ forecasts as our approach is more Etsy than Amazon, with every single line of data (and there are thousands of them) being hand crafted, individually stress tested and cross checked.

It might not be a very scalable approach, but as so many stakeholders in the music business rely on our numbers for business and investment strategy, it is a responsibility we take very seriously. As tempting as it would be just to say ‘CAGR is…’ and populate across the 39 different markets, we know from experience that short cut approaches almost always result in short comings. Perhaps most important of all is the thinking and industry expertise that goes into the numbers. There are no facts about the future, so forecasts are always a mathematical representation of human thought (and, no, I am not opening the AI can of worms). MIDiA clients can get the full 83 page report and 50+ sheet Excel here. Here are some highlights.

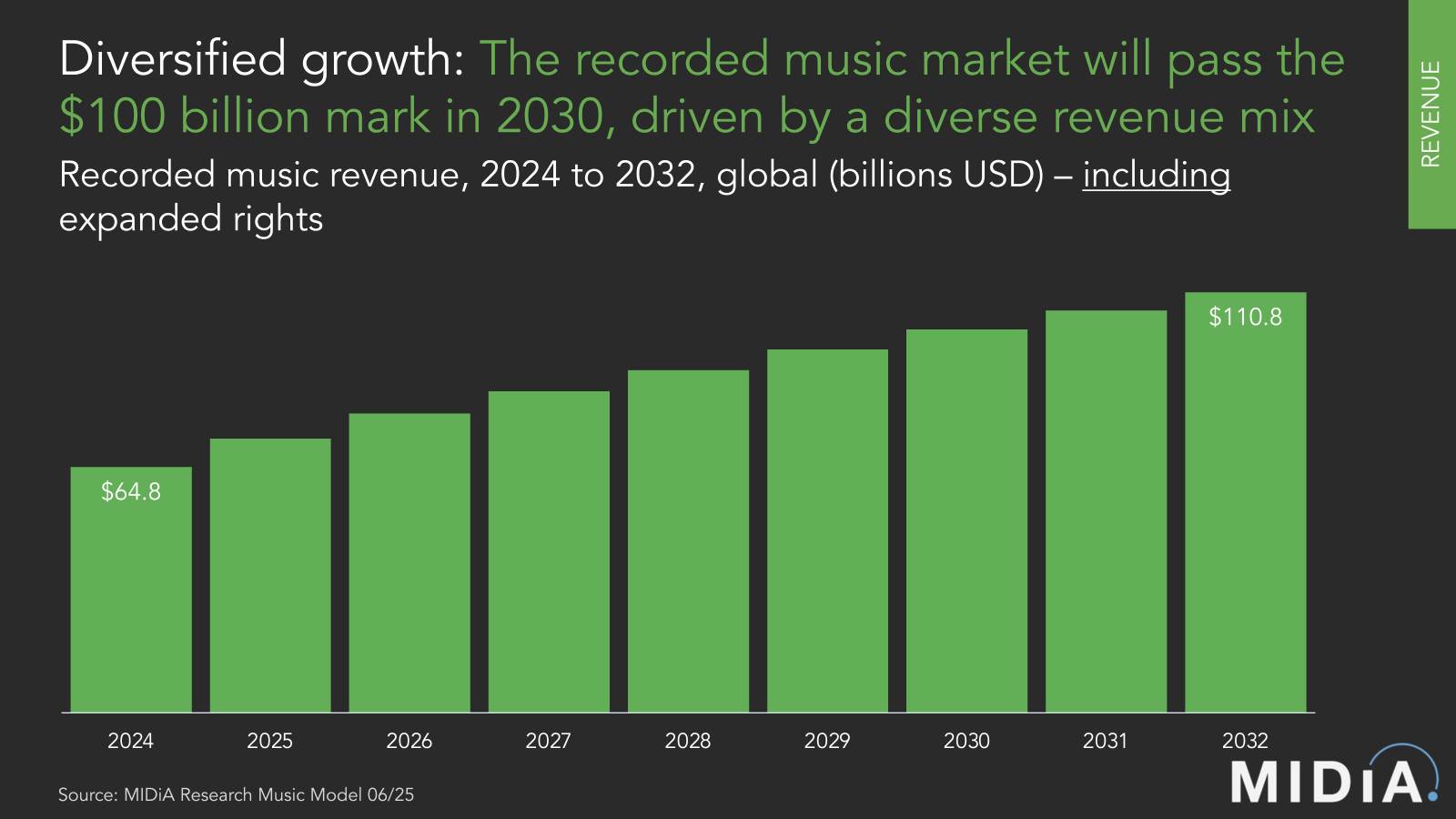

First off, the big number: by 2032, global recorded music revenues will be $110.8 billion. This figure is retail terms (i.e., includes DSP / retailer and publishing revenues) and includes:

- Traditional revenues (streaming, downloads, physical, performance, sync)

- Non-DSP streaming (TikTok, etc.)

- Expanded Rights (labels’ share of live, merch, branding, etc.)

- Label licensing revenue for audio visual content (documentaries, biopics, etc.)

- Production music

- Full representation of the long tail of independent artists and labels

That is the maximalist view. The more minimalist view (label revenues excluding Expanded Rights) sees 2032 revenues reach $51.2 billion.

Featured Report

Splice x MIDiA Sounds of 2026 House on the rise

We zoom in on the trends and microtrends driven by the music industry’s biggest fans and most influential tastemakers: creators. Turn page after page of trends unfolding in real-time and see how Splice’s dataset is the barometer for the state of music today.

Find out more…After something of a boom year in 2023, revenue growth slowed to 4.3% in 2024. In fact, 2024 continued an oscillating growth pattern we have seen all decade, with strong growth years followed by weaker ones. The years with weaker growth coincided with declines in physical and (most often) weaker streaming growth. While this gives physical a kingmaker status, it also reflects maturing streaming growth: when the main revenue source grows at more modest rates, shifts in smaller revenue sources is the difference between strong and weaker growth.

We titled this year’s report ‘Recalibration’ as everything points in this direction:

- New growth dynamics: Oscillation and slowing streaming are the new growth framework for the global market

- Clear shift away from the West: Close to four firths of subscriber growth came from non-Western markets and China became the world’s fourth largest recorded music market. We titled last year’s report ‘Rise of the Global South’. This is the market’s new reality. Which helps explain why so many Western rightsholders are snapping up Global South repertoire and rightsholders. Will catalogue investors follow suit?

- New DSP power dynamics: DSPs are growing influence and power, as reflected the ‘bundles’ licensing discounts. Labels got their ‘artist centric’ licensing in return but the long-term implication is DSPs have the precedent of reducing the royalty pot

- New outlook for ad supported streaming: Revenue was flat in 2024. Part of this was actually a good news story (more music videos being monetised in the higher value confines of YouTube Premium). Part of it was another reflection of DSP power, with advertisers increasingly opting for the better targeting of podcast inventory versus music

- Rapid rise of AI: While rightsholders were locked in legal battles, the marketplace has become awash with generative AI companies and this music is flooding DSPs. While some of these companies are seeking to operate ethically and in partnership with rightsholders, many are pursuing the ’do first, ask forgiveness later’ approach that served earlier disruptors like YouTube and TikTok so well

As you can imagine, with an 83-page report, this is but a tiny taster of the report, but hopefully it has given you a sense of the macro dynamics at play in today’s and tomorrow’s music business. If you want to go a little deeper still, keep an eye out for an exclusive video of the report’s analysts talking through some more of our thinking and numbers. In the meantime, if you are a client, you can find the report here.

Click here to join the early access list for Thursday’s exclusive 2025-2032 music forecast summary video, where Tatiana Cirisano, Perry Gresham, and I discuss the report’s key insights!

The discussion around this post has not yet got started, be the first to add an opinion.