K-pop’s global bifurcation: A genre at a crossroads

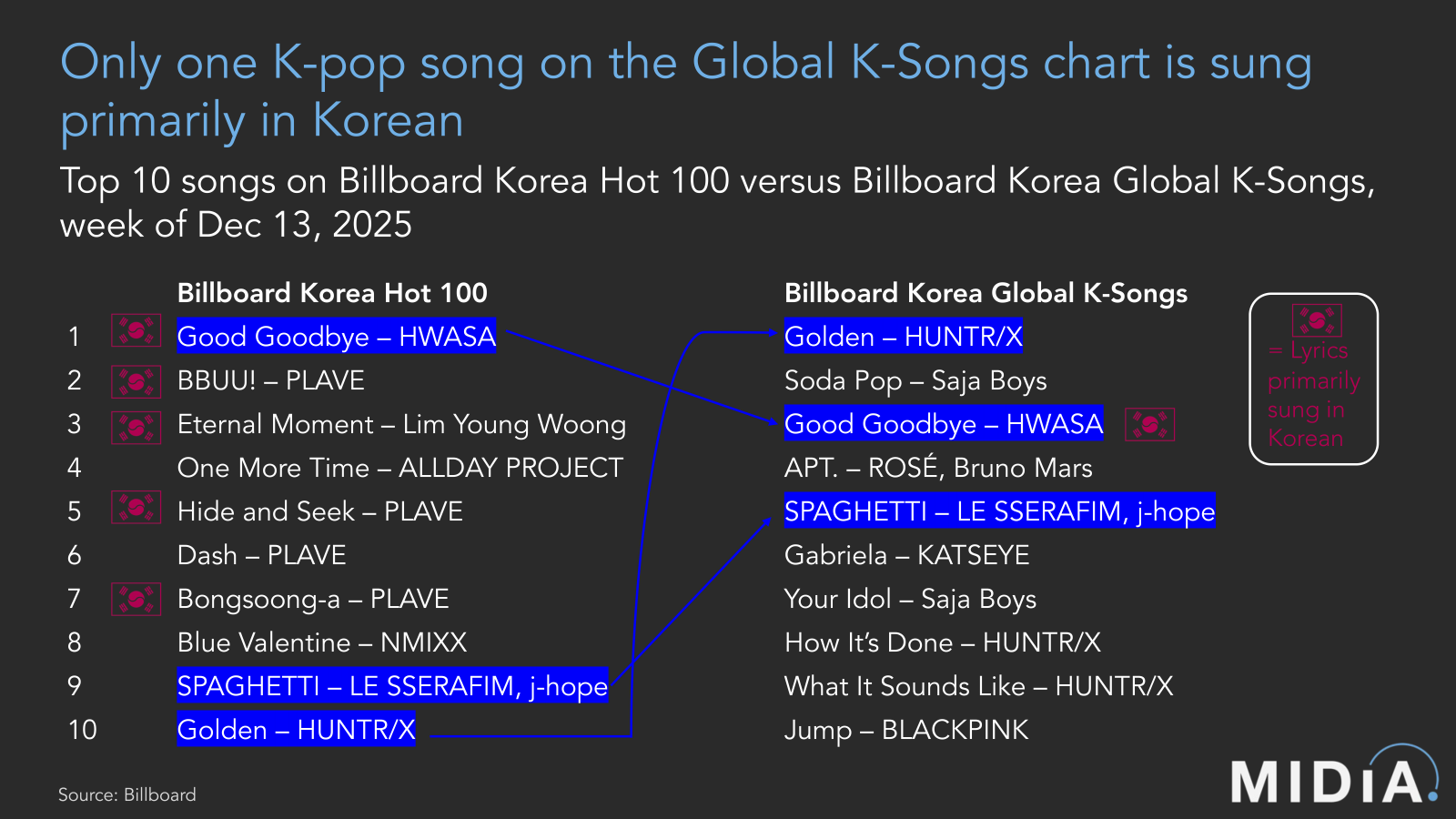

Billboard recently released two new weekly charts tracking Korean music – Billboard Korea Hot 100 and Billboard Korea Global K-Songs. While the Hot 100 ranks songs based on streaming and sales numbers within South Korea, the Global K-Songs chart focuses on global popularity, ranking the top songs either by Korean artists or in the Korean language based on “streaming and sales activity from over 200 territories around the world, including South Korea”. In just the second week of these charts’ existence (week commencing 13th December), comparing the top 25 songs on each reveals an emerging divergence within K-pop – global popularity no longer signals domestic popularity in the genre. In exporting to a global stage, K-pop has evolved to suit an international audience – perhaps at the expense of its domestic one.

The domestic and global charts have only six songs in common

Only six tracks appear among the top 25 of both Korea’s domestic Hot 100 and the Global K-Songs chart, and only three are shared in the top 10. Unsurprisingly, ‘Golden’ from Netflix's smash hit Kpop Demon Hunters is among the crossover successes. However, while ‘Golden’ tops the global chart and is joined by two other Demon Hunters tracks in the top 10, ‘Golden’ falls to number 10 on the domestic chart and is the sole Demon Hunters track listed. ‘Good Goodbye’ by HWASA and ‘SPAGHETTI’ by LE SSERAFIM and J-Hope are the other two crossover successes – but they, too, occupy quite different ranks on each chart.

Korean listeners gravitated toward fewer artists, but more soloists

The Korea Hot 100 has a narrower range of artists than the Global K-Songs chart, as 14 unique artists are responsible for the top 25 songs domestically (collaborations are counted as one artist), compared to the 18 artists representing the Global K-Songs’ top 25 (note: Kpop Demon Hunters is counted as one artist). However, among the Korean Top 25 are six solo artists – three of whom were not previously part of a K-pop group. By contrast, all seven solo artists on the global Top 25 were originally members of K-pop groups. Globally, the transition from K-pop group member to Western-focused pop artist has proven the most successful method of launching a solo career. Domestically, however, many of the soloists are not from a K-pop background at all – Korea’s growing indie scene and diversifying music taste have propelled artists like Hanroro and Lim Young Woong up the domestic charts.

Label representation changes as the “Big 4” push globally

The labels represented in each chart’s Top 25 highlight shifting focuses among Korea’s largest entertainment companies. While the global chart is dominated by Western major labels and three of Korea’s “Big 4” entertainment companies (HYBE, JYP Entertainment, YG Entertainment), a long tail of Korean labels rule the domestic chart. Meanwhile, the “Big 4” represent less than a quarter of its top 25 songs. It is no secret that companies like HYBE are prioritising global export – not just of the K-pop genre, but of the K-pop methodology, with new initiatives for artists based in Africa and Latin America. However, this has left a vacuum in the domestic market that small and mid-tier Korean labels are rushing to fill.

“Global K-pop” often means “English K-pop”

The main language represented among the Korea Hot 100 top 10 is – understandably – Korean. While four songs mixed Korean and English, and ‘Golden’ is primarily sung in English, five of the Top 10 songs are Korean-language releases. By contrast, only one song on the Global K-Songs chart – ‘Good Goodbye’ – is primarily sung in Korean. The other nine entries are at least half in English, with English being the primary language for eight. This follows the growing trend of non-Korean-language K-pop songs, as artists adapt to better connect with international audiences. This strategy is not new, as K-pop artists have long recorded songs in Japanese and Chinese to appeal to those markets, but it has rarely been done with this much volume and frequency. The push for more English K-pop releases has proven successful in the US, as three K-pop acts were nominated for major Grammy award categories, including Best New Artist, Song of the Year, and Record of the Year – all performing in English.

The bifurcation of K-pop

Groups like HYBE’s first US-based girl group KATSEYE – who have two songs in Global K-Songs’ Top 25 – prove that exporting the “K-pop framework” to the global market can be successful. Kpop Demon Hunters is another example of the “global K-pop” strategy at work – while the film is distinctly “K-pop” in its aesthetic, its songs are primarily in English, and it has resonated with a global audience. Instances like these make it difficult to identify what sets K-pop apart from Western pop, as its globalisation has removed many aspects that used to define K-pop, such as the language. However, the domestic K-pop charts show that those aspects are still a part of K-pop – just not a part of global K-pop. On the contrary, many of the qualities that catapulted K-pop to global fame – strong fandom, meticulous performance, rigorous artist development – are not inherently “Korean”, even if they tend to be associated with K-pop groups.

In the wake of K-pop’s Grammy nominations and the success of acts like KATSEYE, it is easy to make the claim that K-pop has officially gone global. However, comparing the two new Billboard Korea charts reflects that it is not necessarily the K-pop genre that has been exported, but parts of the K-pop major-label methodology – including aspects that are not specifically Korean in nature. As this trend continues, the boundaries of what defines “K-pop” will only become blurrier. While going global gives K-pop the opportunity to access a much larger market, this success may come at the expense of musical identity – leading to a K-pop without the “K”.

The discussion around this post has not yet got started, be the first to add an opinion.