What podcast slowdown? 1.2 billion people will be listening by 2030

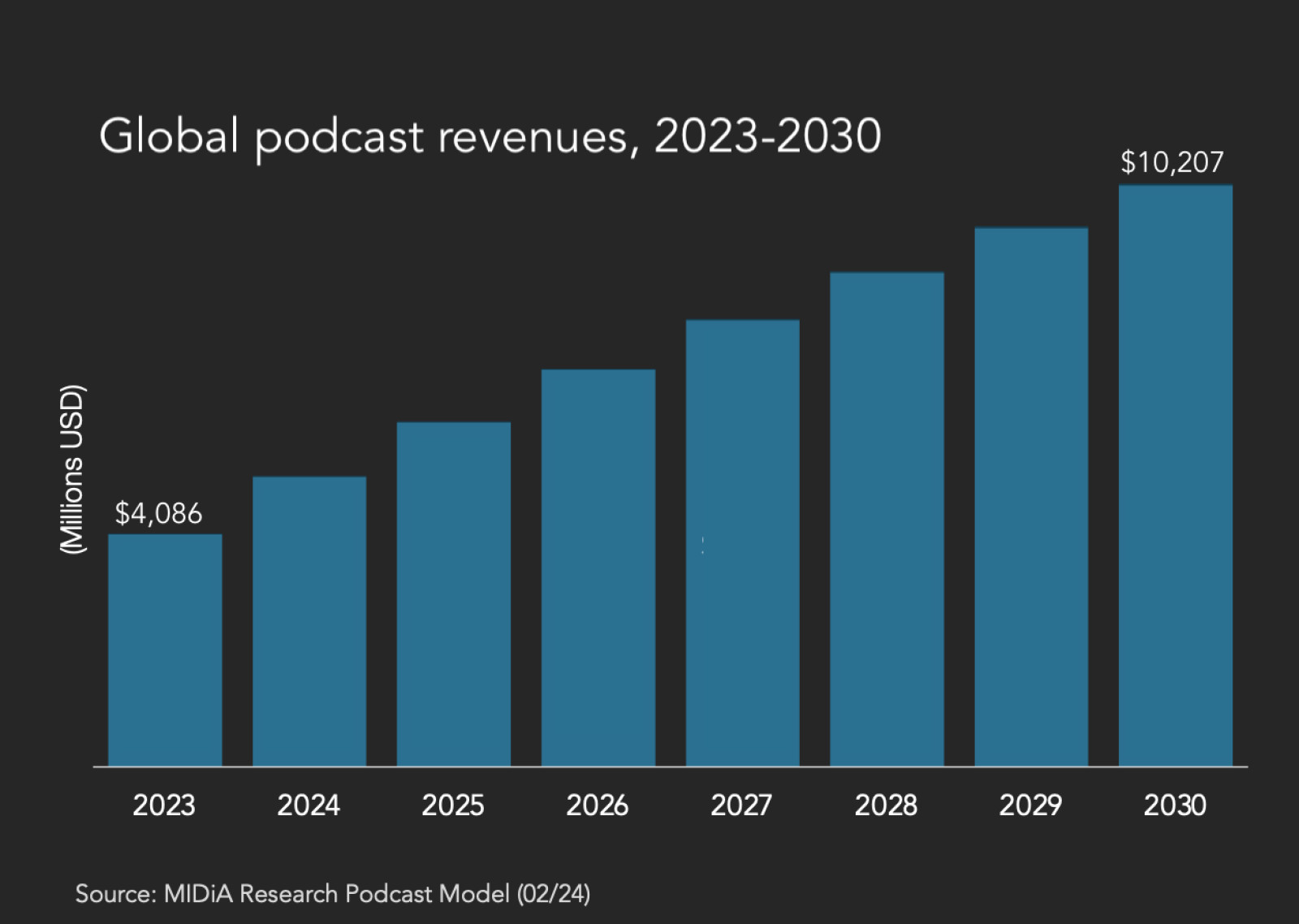

Is podcasting slowing or growing? Both, as it turns out. With marketing and advertising budget cuts contributing to layoffs and cancellations at major podcasting players like Spotify and NPR, 2023 was an uncertain time for the podcast industry. While it is true that growth may have slowed significantly relative to 2019-2021, MIDiA’s latest report, ‘MIDiA Research 2024-2030 global podcast forecasts: Road to a $10 billion business’, outlines that there is plenty of reason to remain optimistic about podcasting.

It is important to keep some perspective here: despite recent bad press, global podcast revenue grew 37.6% and global podcast users grew 23.4% in 2023. Compared to 80.6% revenue growth and 53.9% user growth in 2021, that may be a big slowdown on paper. However, it is still incredibly healthy (there is also the anomalous pandemic boom to take into account during that unprecedented growth period from 2020 to 2021). By the late 2020s, annual growth will start to level out and approach 5%, but by then the global podcast industry will be worth $10 billion and there will be 1.2 billion podcast users worldwide.

Podcasting’s emerging trajectory

Podcast growth may be levelling out year on year, but this is to be expected as global revenue and users increase. Moreover, there is much further growth to be had — especially from markets beyond the US and UK. By 2030, the number of podcast listeners in the Asia Pacific region will trounce that of any other market worldwide. Unsurprisingly, most of those users will come from the two most populated countries in the world: China and India. Combined with Latin America, the Asia Pacific region will account for more than two-thirds of global podcast users.

This has big implications for which platforms will win the most podcast users in the years to come. Considering what we already know about the consumption behaviours of users in Asia Pacific and Latin America, it will be difficult to dethrone the biggest multimedia platform in the world: YouTube.

Featured Report

MIDiA Research 2026 predictions Change is the constant

Welcome to the 11th edition of MIDiA’s annual predictions report. The world has changed a lot since our inaugural 2016 edition. The core predictions in that report (video will eat the world, messaging apps will accelerate) are now foundational layers of today’s digital economy.

Find out more…What happened to Apple?

As with digital music consumption (remember iTunes?), Apple was the first big mover in podcasts. For over a decadee, Apple and podcasting were practically synonymous. Once Spotify started gaining market share somewhere between 2015 and 2017, Apple’s podcast power started to wane. As recent as 2019, Apple still had roughly a fifth of the market share in podcasting — 9.2 percentage points lower than Spotify. By 2023, Apple tumbled to roughly half of that, butSpotify’s market share fell too. The decline of bothis thanks to the speedy growth of YouTube video, which more than tripled its market share from 2019 to 2023 to become the top source of podcast consumption.

While YouTube’s growth in podcasting may have something to do with the growing popularity of video podcasts, increasing podcast penetration in YouTube-heavy markets is also driving this growth. This is an important development in the overall growth of podcasts, but there are also economic implications here. After all, the US remains the advertising powerhouse of the world, and podcast revenue will continue to be driven by advertising. This gives the US an outsized influence on global podcast dollars, even as Asia Pacific has an outsized influence on global podcast users.

The discussion around this post has not yet got started, be the first to add an opinion.