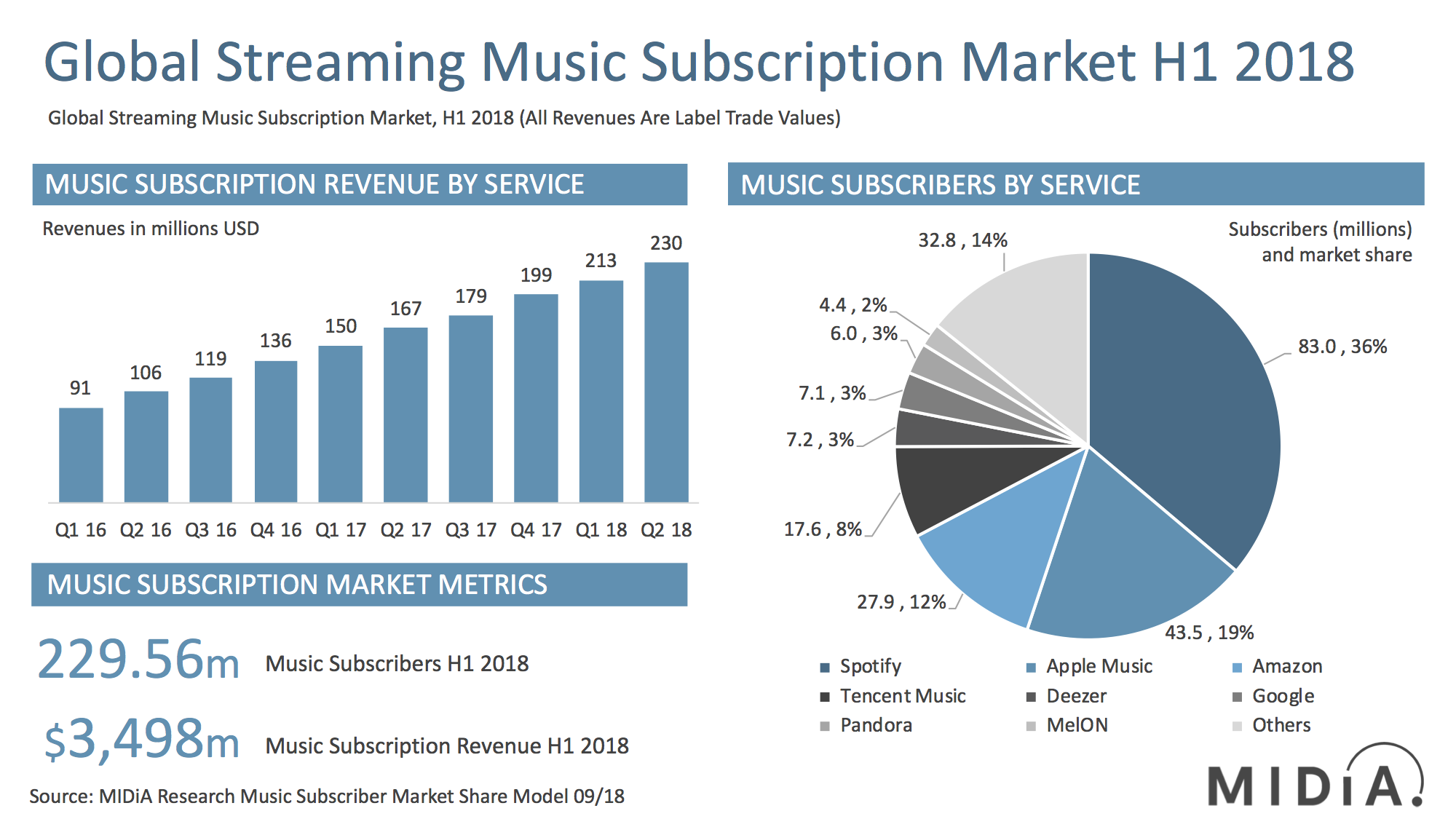

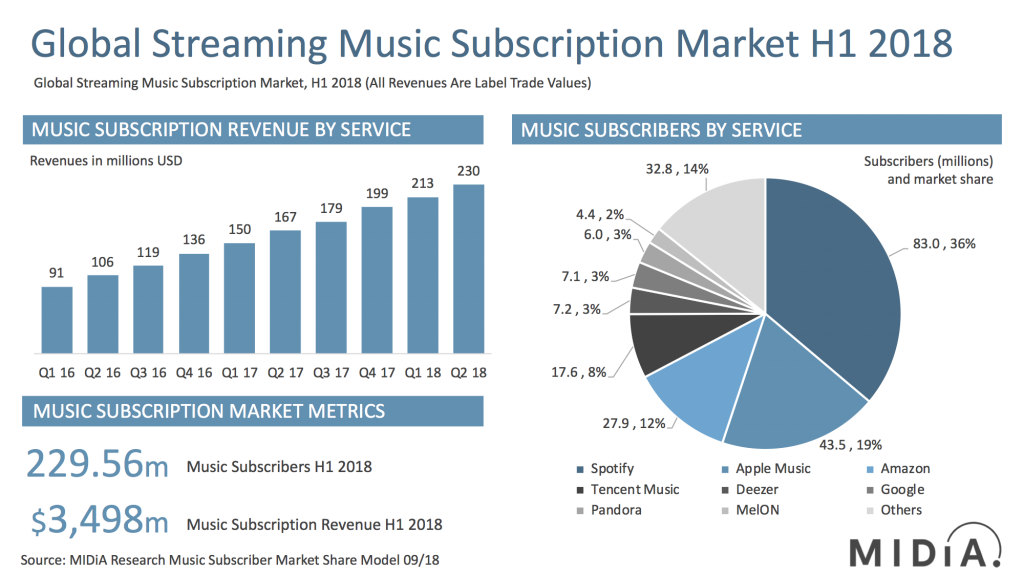

Mid-year 2018 streaming market shares

Music subscribers grew by 16% in the first half of 2018 to reach 229.5 million, up from 198.6 million at the end of 2017. Year-on-year the global subscriber base increased by 38%, adding 62.8 million subscribers. This represents strong but sustained, rather than strongly accelerating, growth: 60.8 million net new subscribers were added between H1 2016 and H1 2017. This indicates that subscriber growth remains on the faster-growth midpoint of the S-curve. MIDiA maintains its viewpoint that this growth phase will last through the remainder of 2018 and likely until mid-2019.

This will be the stage at which the early-follower segments will be tapped out in developed markets. Thereafter, growth will be driven by mid-tier streaming markets such as Japan, Germany, Brazil, Mexico, and Russia. These markets have the potential to drive strong subscriber growth, but, in the case of the latter three, will require aggressive pursuit of mid- tier products – including cut-price prepay telco bundles, as seen in Brazil. Without this approach, the opportunity will be constrained to the affluent, urban elites that have post-pay data plans and credit cards. These sorts of products though, will of course deliver lower ARPU in already lower ARPU markets. All of this means: expect revenue to grow more slowly than subscribers from mid 2019.

The key service-level trends were:

Featured Report

Ad-supported music market shares Spotify ascending

Ad-supported streaming has always occupied a unique and slightly contentious place in the music industry ecosystem. On the one hand, ad-supported still represents an effective way to reach consumers at scale, creating a wider subscriber acquisition funnel.

Find out more…Apple Music: Apple added two points of market share, up to 19%, and up three points year-on-year, with 43.5 million subscribers. Apple Music added the second highest number of subscribers – 9.2 million, with the US being the key growth market.

Amazon: Across Prime Music and Music Unlimited Amazon added just under half a point of market share, stable at 12%. Amazon experienced the most growth within its Unlimited tier, adding 3.3 million to reach 9.5 million in H2 2018. In total Amazon had 27.9 million subscribers at the end of the period.

Others: There were mixed fortunes among the rest of the pack. In Japan, Line Music experienced solid quarterly growth to reach one million subscribers, while in South Korea MelOn had a dip in Q1 but recovered in Q2 to finish slightly above its Q4 2017 figure. Elsewhere, Pandora had a solid six months, adding 0.5 million subscribers, while Google performed strongly on a global basis

The mid-term report card for the music subscriptions market in 2018 is strong, sustained growth with a similar second half of the year to come.

There are comments on this post join the discussion.