Music subscriber market shares 2023: New momentum

With UMG leading the charge to reshape the music industry into a more label-friendly form, 2023 may, with hindsight, go down as the year before everything changed. Whatever lies ahead though, new models will take time to deliver benefits. Music subscriptions are therefore going to remain the bedrock of music rightsholder revenues for the foreseeable future. So, it is a good thing that music subscriptions had such a good year in 2023.

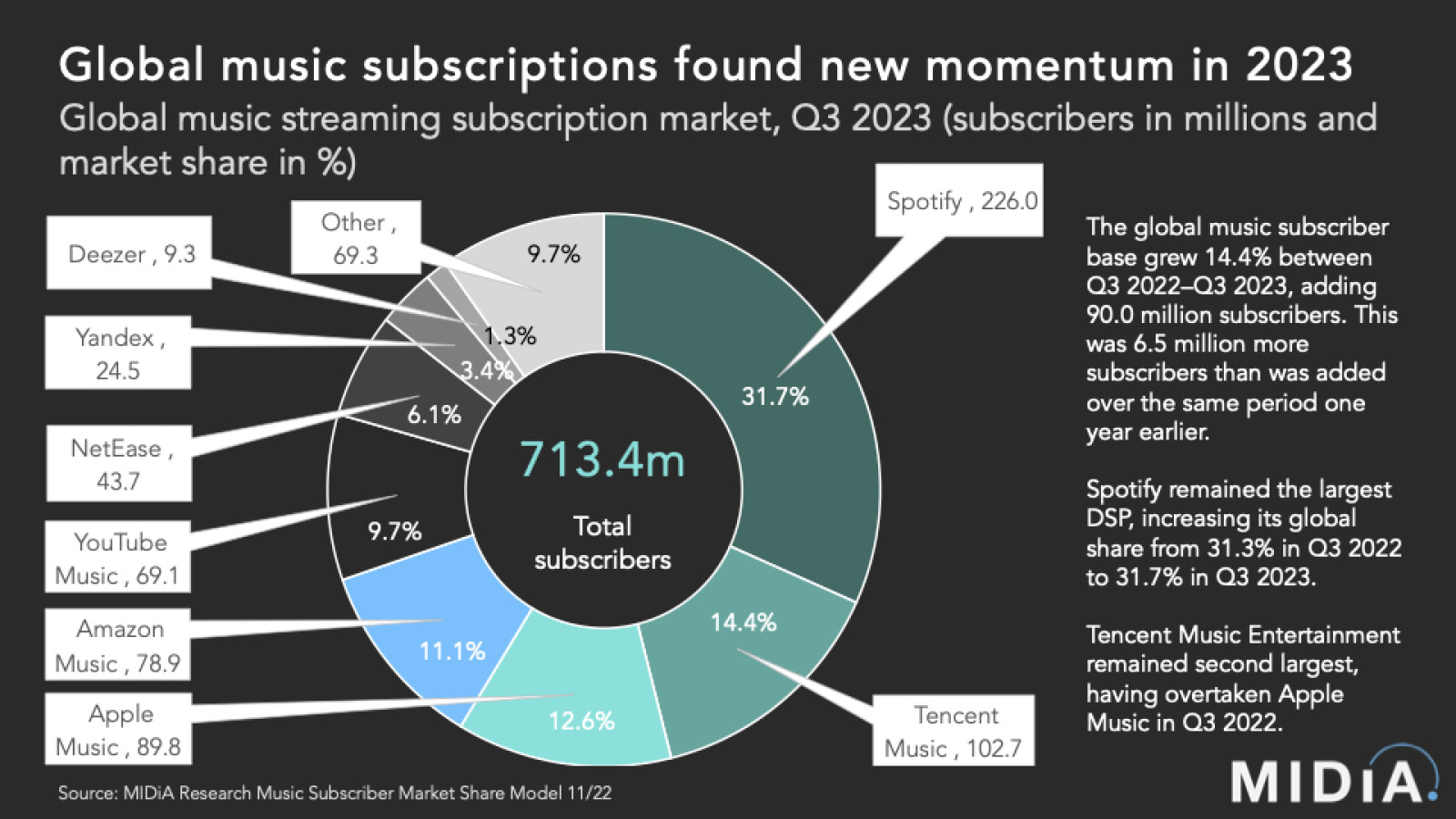

As of Q3 2023, there were 713.4 million music subscribers globally, which was 90 million up on the 623.4 million one year earlier in Q3 2022. This matters for two reasons:

1. We are already nearly three quarters of the way to having one billion music subscribers globally. That is no small achievement. For context, as recently as five years ago, we had only just passed the quarter of a billion subscriber mark

2. The 90 million subscribers added in the 12 months to Q3 2023 was more, yes more(!), than the 83.5 million added one year earlier. In fact, the number added was nearly as many as those added in 2020. Not bad for a maturing category with key markets hitting near-saturation

However, there is a bit of a problem with looking at the global market: it is increasingly no longer a global market, but instead, one of two halves: the West and the Global South, with each region throwing off dramatically different metrics and growth narratives.

Nowhere is this better illustrated than in the market share rankings:

· Spotify dominated the global music subscriber base in Q3 2023 with 31.7% market share. More than that, it actually increased its share from 0.4 points from Q3 2022. So, for all the flak Spotify has thrown at it, it outgrew the market in 2023. Newer, emerging market territories were central to this growth, but it was Spotify’s traditional heartland (North America and Europe) that drove the majority (59%) of its subscriber growth. Compare and contrast this with the all-DSP picture, where North America and Europe drove just 29% of subscriber growth, with Asia Pacific accounting for nearly two thirds of all non-Western subscriber growth

Featured Report

Splice x MIDiA Sounds of 2026 House on the rise

We zoom in on the trends and microtrends driven by the music industry’s biggest fans and most influential tastemakers: creators. Turn page after page of trends unfolding in real-time and see how Splice’s dataset is the barometer for the state of music today.

Find out more…· China, a market in which only Apple of the Western DSP operates, underpins this non-Western growth, and the clearest manifestation of this is Tencent Music Entertainment (TME). With 102.7 million subscribers in Q3 2023, TME represents 14.4% of all global subscribers, despite this being an effectively China-only number. NetEase Cloud Music (6.1% share and China-only) and Yandex (3.4% share and Russia-only), further represent the dynamic growth from regions where Western DSPs largely do not operate. This is the new, bifurcated nature of the global music subscriber market

· Apple Music (12.6%), Amazon Music (11.1%) and YouTube Music (9.7%) represent the remainder of the leading Western DSP pack. Along with Spotify, these three DSPs represent 65% of the global market, but only 59% of 2023 growth. Western DSPs are still the core of the market, but they are collectively losing share. But, even within these four, there is a diverging picture, with YouTube Music and Spotify gaining share in 2023 while Amazon and Apple lost share. Between Q3 2022 and Q3 2023, Spotify added more subscribers than all three other leading Western DSPs combined

2023 was a strong year for music subscriptions, delivering more growth than perhaps had been expected in such challenging macro-economic and geo-political circumstances. Even North America and Europe grew slightly faster in 2023 than in 2022. But, as commendable as squeezing more growth out of otherwise mature markets is, the inescapable paradigm shift is the emergence of the Global South as the growth driver of tomorrow’s music subscriber base.

Want even more detail? Check out the full music subscriber market shares report and data set, with data for more than 20 DSPs across more than 40 territories, with data for every quarter from Q4 2015 to Q3 2023.

For more info email stephen@midiaresearch.com

The discussion around this post has not yet got started, be the first to add an opinion.