Indie labels are trading quality for quantity as they let go of the “volume game”: MIDiA’s latest label survey

In MIDiA’s third annual independent label and distributor survey, “less is more” is the name of the game. Drawing from a survey of 144 labels and distributors that self-identify as independent, MIDiA’s latest report explores how the indie sphere is adapting to the rapidly-changing industry landscape and where they see themselves going next. According to the survey, independent labels are going back to the drawing board, turning their focus to building a solid core roster rather than signing as many artists as possible. If 2024 was about recalibrating, then 2025 was about refining.

Indie labels are quitting the “volume game”

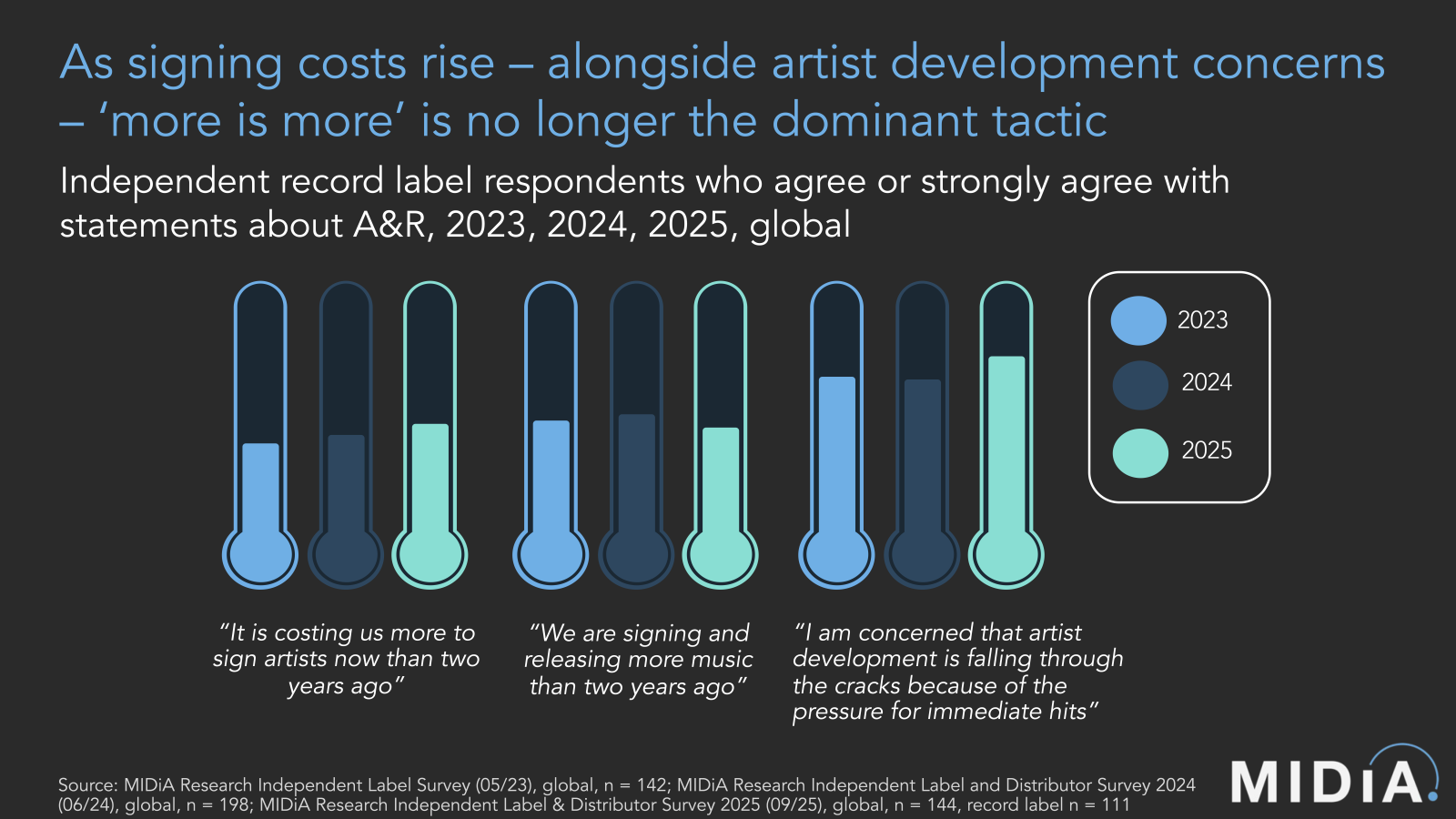

Indie labels are tightening their artist rosters for a variety of reasons, the most prominent being rising signing costs and artist development concerns. While less than half of labels surveyed feel that signing artists costs them more now than two years ago, the percentage of those who feel this way has increased nearly ten percentage points since 2023 – growing ever closer to becoming the majority. Consequently, the percentage of labels that are signing and releasing more music is decreasing, after a 2024 peak. Fears over a lack of substantial artist development is also driving a shift to slimmer rosters. While this has been a consistent concern in previous years, it reached a new high in 2025, with nearly three-quarters of labels surveyed agreeing that artist development is falling through the cracks due to the pressure for immediate hits.

Content overwhelm is exacerbating these problems. While “breaking through the noise” is the biggest challenge in today’s democratised streaming era, the struggle no longer ends when an artist rises above the tidal wave of tracks. Retaining fan interest beyond a successful release is now another concern, with over three-quarters of labels surveyed agreeing that audience retention has become more difficult – if a release cuts through at all. The beginning of the decade was dominated by a “more is more” mindset – we even went as far as to subtitle our 2023 independent label report “playing the volume game” – but this strategy is no longer working.

Featured Report

Streaming strongholds High-potential markets for global music players

While the balance of music streamers continues to tip towards global south markets, their smaller ARPU rates limit their revenues. Meanwhile, periodic price-rises and the advent of supremium will reinforce the contributions from the West. This report highlights streaming strongholds, those markets which, underscored by high music engagement and his...

Find out more…A realignment of priorities

Nowhere is this shift to quality over quantity clearer than in independent labels’ top priorities for 2026. While “signing more artists” fell by ten percentage points between 2023 and 2025, “focusing on fewer artists” has increased by a whopping 16 percentage points in the same time period. Meanwhile, expansion-focused strategies like exploring new revenue streams and breaking into new markets have been put on the backburner for the time being – with the majority of labels no longer listing “new revenue streams” as a top priority. Independent labels are strengthening what they already have. While we saw the beginnings of this shift in our 2024 report, it has become a more dominant strategy among indie labels in the past year.

2026 is set to be a year of reaping the benefits of this “less is more” mindset. Last year, indie labels focused on strengthening their foundations by reevaluating their priorities and right-sizing their roster. Now, they can begin building from there, with a stronger focus on quality over quantity. The indie landscape – like the music industry at large – has changed drastically in recent years. Gone is the frantic need to sign as many artists as possible and release a constant stream of music. Now, indie labels are capitalising on their strengths – doing what they already do well even better.

The indie landscape is constantly evolving. For more insights into the current state of independent labels, as well as where they are going next, clients can download our latest report “Independent label and distributor survey | Less is more” here. If you are not a client but would like to learn how you can access this report, reach out to enquiries@midiaresearch.com.

The discussion around this post has not yet got started, be the first to add an opinion.