Spotify Q4 2019: First signs of the new Spotify

Spotify’s Q4 2019 results reflect another strong quarter and a good year for Spotify. Look a bit deeper, however, and there are the first signs of the new company that Spotify is building – and they point to a very different and much bolder future.

First, here are the headline metrics:

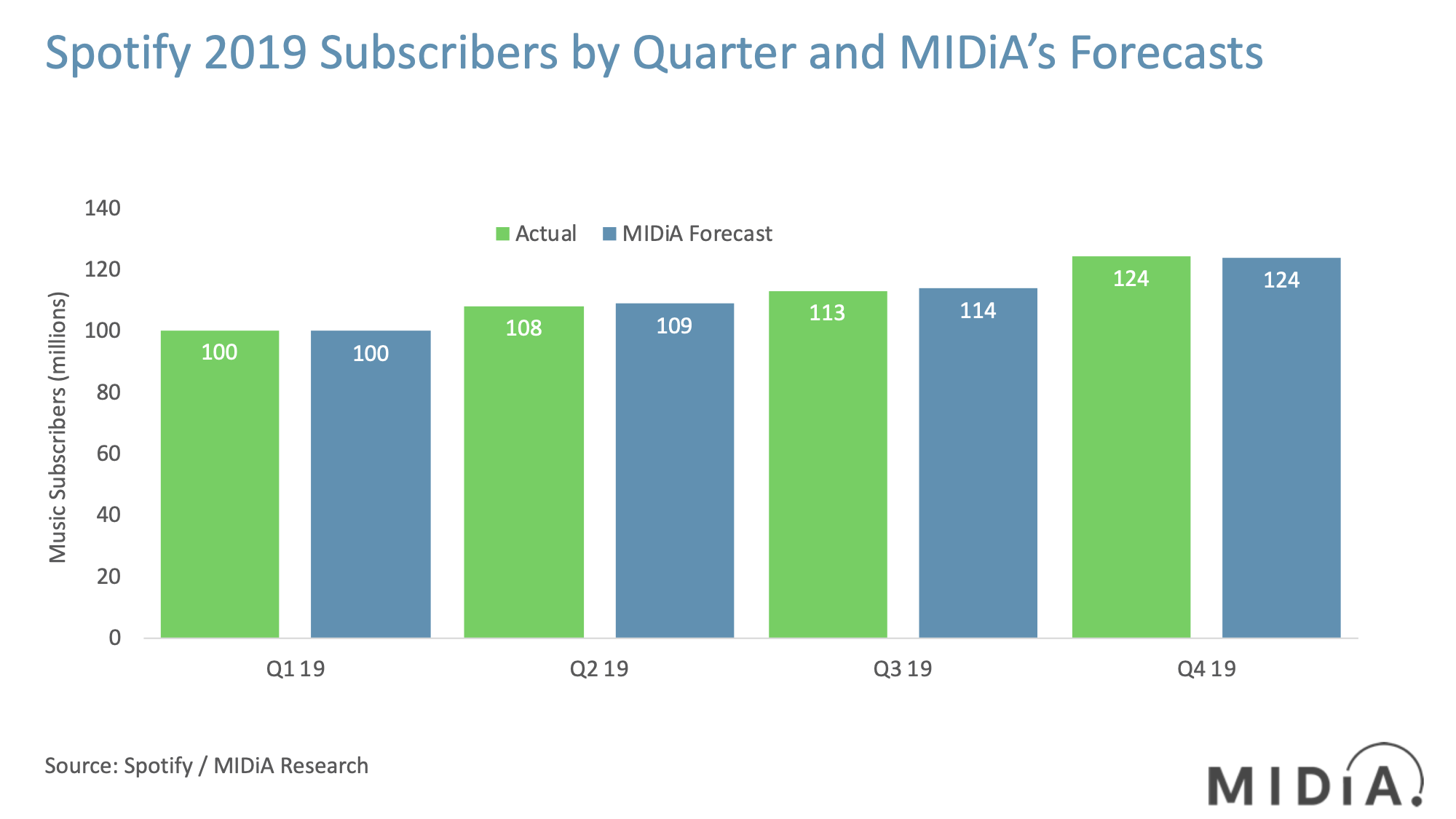

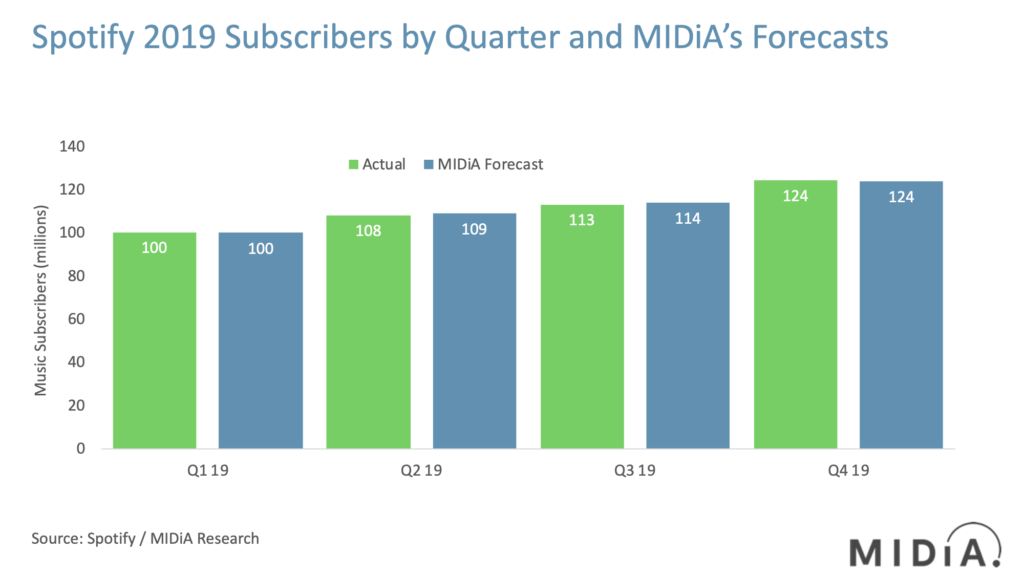

- 124 million subscribers (exactly in line with MIDiA’s forecast built earlier in the year. In fact, we’ve been pretty good with our quarterly subscriber forecasts throughout the year – see the chart at the bottom of this post).

- Six million inactive subscribers (flat from Q3 2019).

- 271 million monthly average users (MAUs) and 153 million ad-supported MAUs, which is a paid conversion rate of 45.8%, down a little from Q3 2019 and Q4 2018 with Rest of World the fastest-growing ad-supported region. This fits with early-stage growth for Spotify in new markets. Unlike markets in Europe and the Americas, Spotify will likely see ad supported remaining a much larger share of the user base long term in markets like India, with less ability to monetise via ad revenue. Spotify needs some big telco deals, especially in India.

- Subscriber churn was down to 4.8% from 5.2% one year earlier. This is slow but steady progress that helps stabilise Spotify’s business and helps net adds grow faster.

- Subscriber average revenue per user (ARPU) was €4.65, down 5% on Q4 2018. Spotify stated that much of this decline was down to “the extension of the free trial period across our entire product suite in the quarter”.

- Total revenue was €6.8 billion, up 29% from 2018 with ad supported just 10% of that.

So much for the old, now in with the new...

Spotify’s uphill journey towards profitability is well documented (net margin fell into negative territory again in Q4 2019, to -€77 million). The circa-70% rights costs base is the core issue here, and rights holders have little (no) desire to go any lower – in fact, publishers want increases. Spotify has had to explore where else it can grow its business with cost bases that are less than 70%. Podcasts, marketing and creator tools are the three publicly stated places where Spotify has placed its bets, and the Q4 results show small and early – but nonetheless crucially important – movements in each:

Featured Report

Splice x MIDiA Sounds of 2026 House on the rise

We zoom in on the trends and microtrends driven by the music industry’s biggest fans and most influential tastemakers: creators. Turn page after page of trends unfolding in real-time and see how Splice’s dataset is the barometer for the state of music today.

Find out more…- Podcasts: As MIDiA reported last month, Spotify has been growing its audience very quickly and is now the second-most widely used podcast platform. 44.8 million Spotify users now listen to Spotify podcasts, with total usage up 200% year-on-year (YoY). Though podcast revenue is still only around 1% of Spotify’s total revenues, this reflects Spotify’s overall relative underperformance in ad revenue. This needs to be fixed – at least in a few of the bigger digital ad markets – but podcasts have the additional benefit for Spotify of diluting the royalty pot and thus improving gross margin. Current license agreements have a strict cap on how much the pot can be diluted (and labels have no intention of increasing that cap). But by MIDiA’s estimates, even within the current deals, Spotify could potentially shave off up to seven points of music royalty payments. Little wonder, then, that Spotify said this in its earnings report: “Any decision to accelerate our investment in podcast and technology spend should be viewed as an indication of our belief that our strategy is having tangible results. We have gained even more confidence in the data, particularly around the benefits from podcasts, and as a result, 2020 will be an investment year.”

- Marketing: Spotify launched its paid ad tools for labels and artists in beta in Q4 2019. Early results are positive: +30% click-through and listener conversion rates, and on the sponsored recommendations side, Caroline Music’s Trippie Redd’s fourth album was helped to #1 with sponsored recommendations. Though there has been some pushback from labels feeling that they shouldn’t have to pay to reach their own audiences, Spotify is not doing anything particularly unusual here. The strategy is directly comparable to what Facebook and YouTube do. In fact, record labels spend about a third of what they earn from YouTube on YouTube advertising. The impact of that sort of revenue exchange on Spotify’s commercial model cannot be understated.

- Creators: 2020 is going to be a massive year for creators. Our early estimates are that artists direct generated around $820 million in 2019, growing more than twice as fast as the overall market. 2019 was another big year for the top of the funnel, but we think the even more interesting space is one step earlier: creator tools. Creator tools are the new top of the funnel, before music even makes it onto streaming services. In fact, we think this might be the music industry’s next big growth area – and Spotify is already betting big, with acquisitions like online collaboration tool Soundtrap and artist marketplace SoundBetter. The music industry was, understandably, preoccupied with Spotify competing with it by signing artists and ‘becoming a label’. Spotify backed off from this strategy, but by focusing its efforts on the creator end of the spectrum it is building the foundations for what a record label of the future will look like. Spotify may just be competing with the labels’ future business before they have even realised it. Spotify’s quote says it all (at least to those who are listening for it): “We will continue to grow and expand the marketplace strategy, including with services such as Soundtrap and Soundbetter.As an example, while still early days, Soundtrap doubled its paying subscriber base in Q4. Expect more innovation of products over the coming years.”

The margin impact of these three business areas is already being felt: “The largest driver of outperformance stemmed from slight improvement in the non-royalty component of Gross Margin, including payment fees, streaming delivery costs, and other miscellaneous variances.”

Picks and Shovels

These are the three pillars of the new Spotify – one that will continue to be powered by music, but with profit coming from ancillary services. In the California Gold Rush in the 19th century, the first person to make a million dollars was a man called Samuel Brannan. But he wasn’t a miner; he sold mining equipment. If there is a gold rush, you want to be selling picks and shovels. Spotify has found its picks and shovels.

The discussion around this post has not yet got started, be the first to add an opinion.