Has music reached peak fragmentation?

If you have read any of MIDiA’s work, you will know we keep a close eye on the fragmentation of music consumption. Thanks to both the internet’s democratising force and the rise of recommendation algorithms, consumers are spreading their listening across more songs and artists than ever, while the “hits” are dominating less.

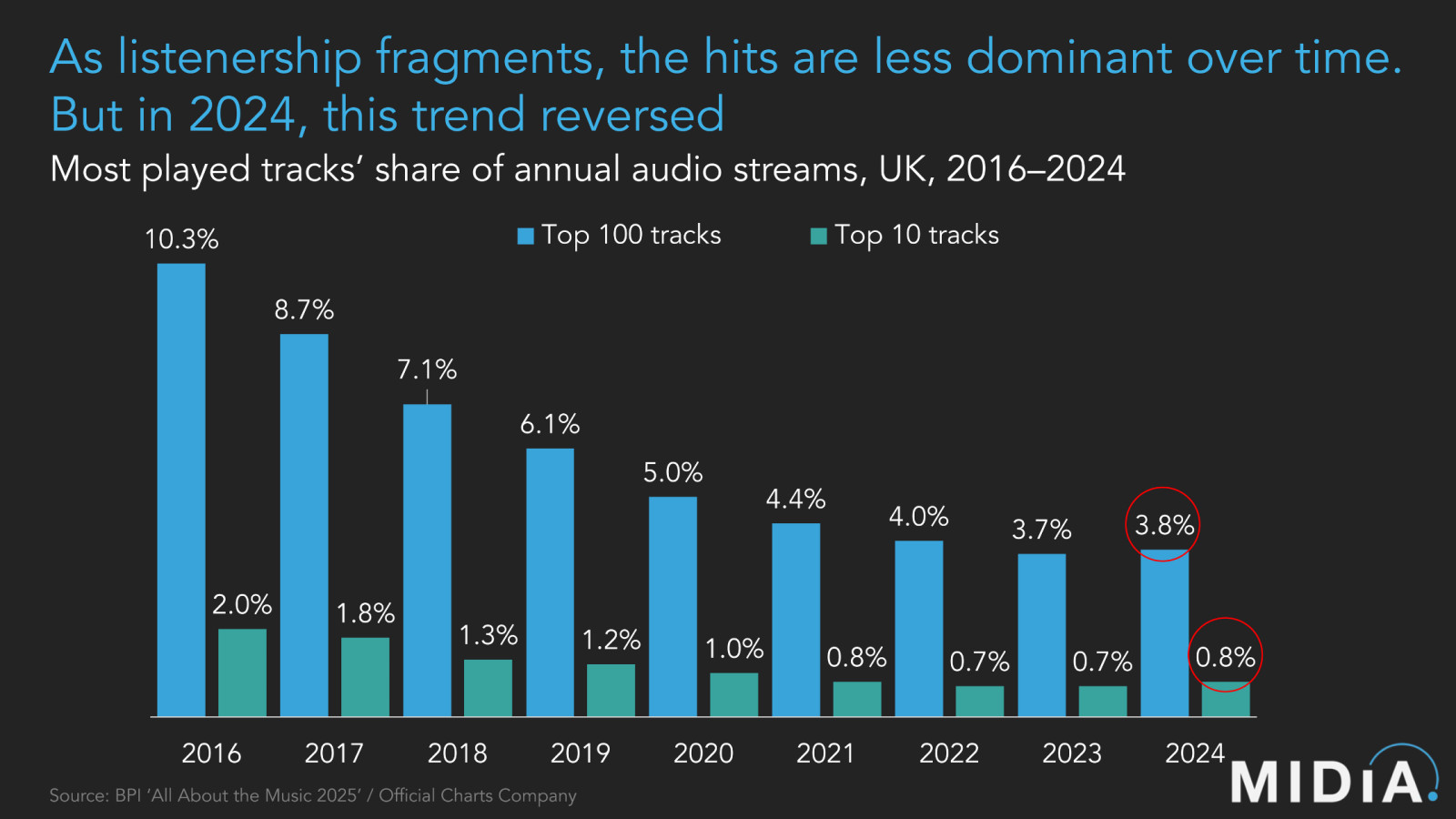

Perhaps nowhere has this trend been more clear than in BPI’s annual All About the Music yearbook, the latest edition of which was published last week. Buried in this 76-page tome is the share of total annual audio streams in the UK that got to the top 100 and top 10 songs. With this key information, we can see that the top 100 tracks on streaming accounted for 10.3% of streams in 2016, and confirm that this percentage has fallen every year since. That is, until 2024 – when it grew from 3.7% in the prior year to 3.8%.

While it remains true that the hits dominate far less than they did in 2016, it is possible we have approached peak fragmentation: that point where the glass has shattered so many times that it simply cannot shatter into smaller pieces anymore. It is also possible that the pieces are coming back together, albeit ever-so-slightly.

Featured Report

Splice x MIDiA Sounds of 2026 House on the rise

We zoom in on the trends and microtrends driven by the music industry’s biggest fans and most influential tastemakers: creators. Turn page after page of trends unfolding in real-time and see how Splice’s dataset is the barometer for the state of music today.

Find out more…Why a fraction of a percentage point matters

That extra 0.1% matters. As consumption has rapidly fragmented, it is increasingly harder to break through the noise – and retain attention afterwards. Hits-reliant businesses like record labels have struggled to apply their usual blueprints for developing and launching superstars to this new reality. Even if fragmentation is now stabilising, those blueprints need major updating (as do the business models driving them), which is why MIDiA has done so much work on scenes and cultural movements. But if the pace of fragmentation is now slowing down, and even slightly reversing, at least we know that we have reached some semblance of stability.

The rate of fragmentation has become slower over time. For example, between 2016 and 2017, the top 100 tracks’ share of streams fell by -15.5%. They continued to fall by double-digit percentages each year until 2022, when the rate of change dropped down to -9.1%, followed by -7.5% in 2023, before reversing course to +2.7% in 2024. This does not appear to be a UK-specific trend, although it may be a Western one. Last year, Billboard noted a decline in catalogue tracks on the Hot 100 chart in the US, a reversal from previous years. While different from what BPI measures, this data does reflect that new hits, and new stars, are breaking through more than before.

What is driving this shift?

It is worth questioning how much this shift is driven by consumers, versus record labels and artists, versus the streaming platforms themselves. The answer is likely a combination of all three. In no particular order, all of these factors likely contributed to 2024 being a turning point:

- 2024 was a notable year for superstar releases, with new albums from Taylor Swift and Beyoncé

- 2024 also saw the rise of a new class of music superstars for arguably the first time in years, including Sabrina Carpenter, Gracie Abrams, and Chappell Roan

- Some of the biggest releases of 2024 were cultural movements that went beyond the music – including the above artists but also, and obviously, Charli XCX’s Brat

- Labels are re-investing in A&R and getting better at developing stars in today’s climate, leaving the “TikTok signing era” behind

- Consumers are seeking shared experiences that bring them closer together – if not an antidote to global political turmoil, then as an antidote to the isolation of our hyper-personalised, algorithmic bubbles

- Changes to streaming platform algorithms have had the effect of reining in fragmentation

- The simple idea that fragmentation cannot continue forever – at a certain point, the pieces cannot get smaller

- Bifurcation theory is playing out: as more new artists build their businesses on social rather than streaming, there is less competition for streams

Another hypothesis is that even if fragmentation is reversing, the makeup of the top ‘100’ songs is what has really changed. In other words, we would expect that a fewer number of artists were behind the top 100 in 2016 compared to the top 100 in 2024. Yet this is not the case – in fact, the number of artists in both years was exactly the same (103). This owes partly to labels’ focus on collaborations in the 2010s, as the 2016 list included nearly double the number of tracks with more than one listed artist than the 2024 list.

What does this mean for the music industry’s future?

This trend reversal will come as a relief to labels. Superstars both new and established are breaking through more than before, and this is pushing back against the ongoing erosion of major label market share in the streaming ecosystem. However, this could also be yet another early indicator that not just music culture, but music consumption, is moving away from streaming towards social platforms. If new generations of artists are focusing their efforts off streaming, it would naturally create a short-term win for labels – in exchange for a longer-term risk. Fragmentation may be slowing down, but its consequences may be just ramping up.

The discussion around this post has not yet got started, be the first to add an opinion.