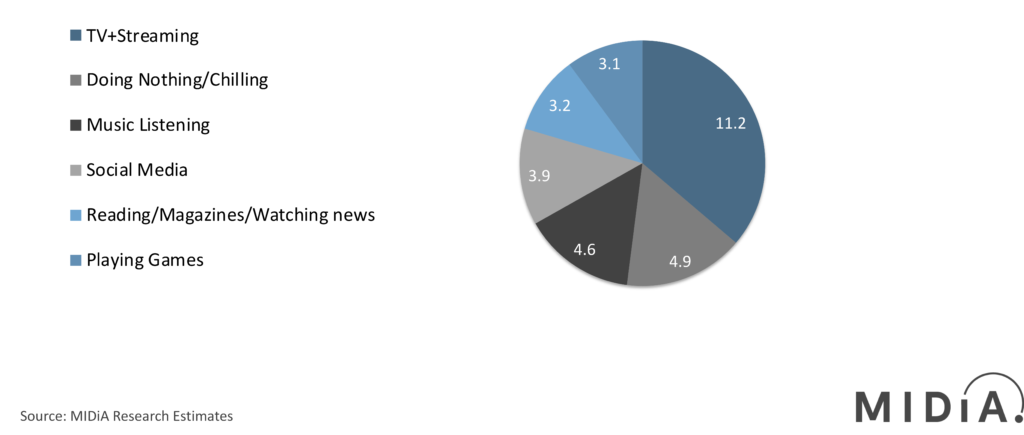

Consumers spend 4.5 hours per day on digital entertainment

The average consumer now spends an estimated 30.73 hours per week on digital entertainment. This works out to approximately 4.5 hours per day.

Allocating eight hours of work and seven hours of sleep, consumers then have about 4.5 hours per day left to do things like eat, commute, socialise, run errands, and conduct general life admin.

Watching TV / streaming is the most prevalent activity among consumers, followed by 'doing nothing' and then 'listening to music'.

With every minute of spare attention competing brands and interests are fighting for, consumers with the available spend are choosing to use it to enable their own choice and control over when and what they see, do, and listen to.

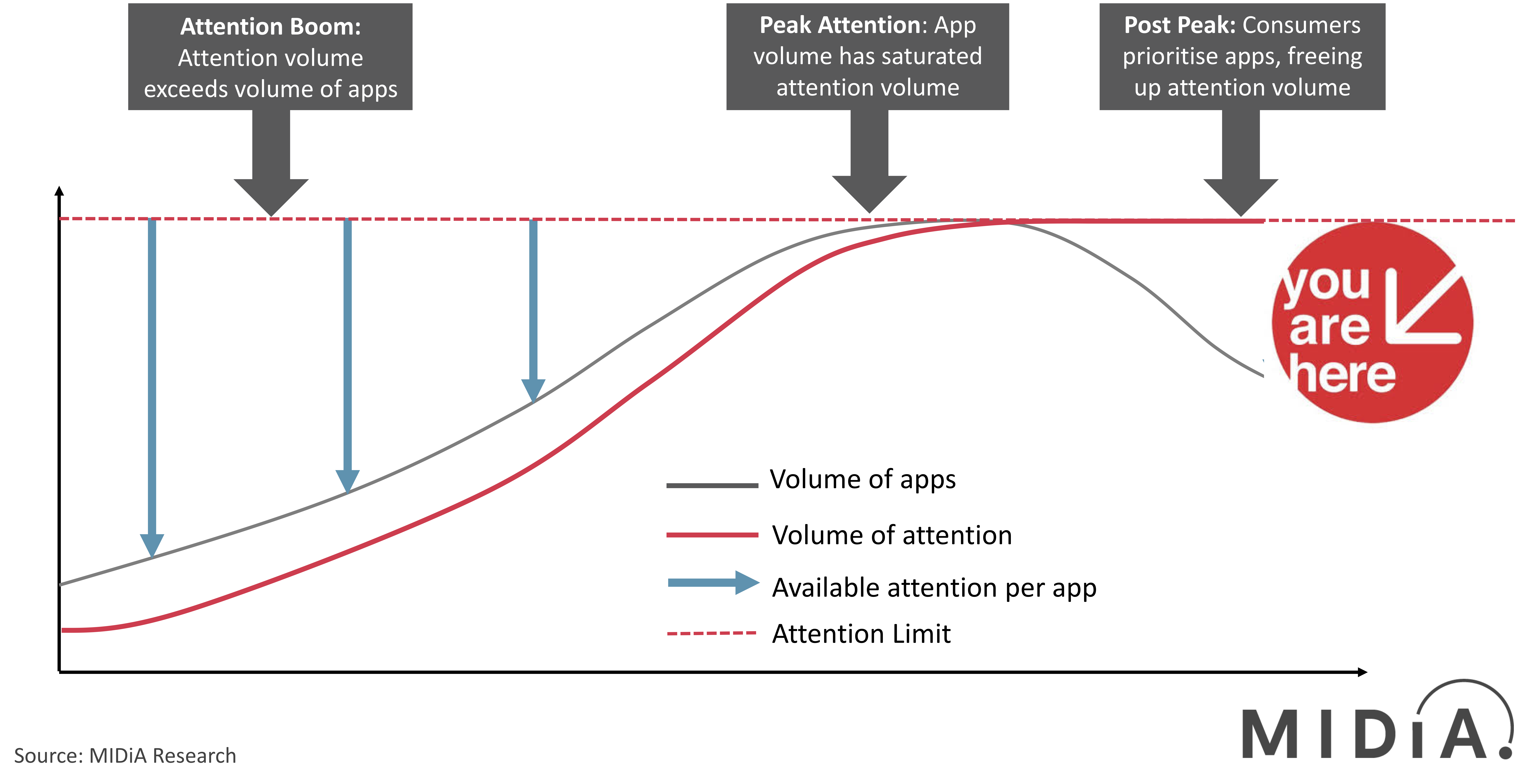

There is nowhere else to grow, engagement-wise, other than fighting for digital attention share amongst existing propositions.

Featured Report

Defining entertainment superfans Characteristics, categories, and commercial impact

Superfans represent a highly valuable yet consistently underleveraged audience segment for the entertainment industry. What drives this disconnect is the fact that – despite frequent anecdotal use of the term – a standardised, empirical definition remains absent, preventing companies from systematically identifying, nurturing, and monetising th...

Find out more…In light of this, engagement is becoming more closely tied to revenue as the world moves further towards subscription business models, which in turn is making traditional entertainment audiences harder to reach as consumers spend more time behind paywalls.

MIDiA has been tracking developments of the attention economy in depth across music, video, games, sports, podcasts, digital news and brands since 2018. Our analysts will be sharing insights about this at the Peak Attention seminar and networking event on November 20th.

Some key findings to be discussed at the event:

- Share of time spent across video, music, games and other entertainment propositions

- Why video is the dominant format in the attention economy

- The total size of the audience that can be effectively targeted by conventional digital advertising is shrinking, in both size and value

- Targeting high-spending consumers

- Competition is no longer isolated within individual entertainment verticals

- The number of hours consumers spend on ‘doing nothing/chilling’ and why this trend will intensify

- Content creators and publishers will see margins squeezed in the long term

- Opportunities behind the paywall

- The valuable $10+ consumer segment

Get a free copy of the Peak Attention report at the event when you sign up. Space is limited.

The discussion around this post has not yet got started, be the first to add an opinion.