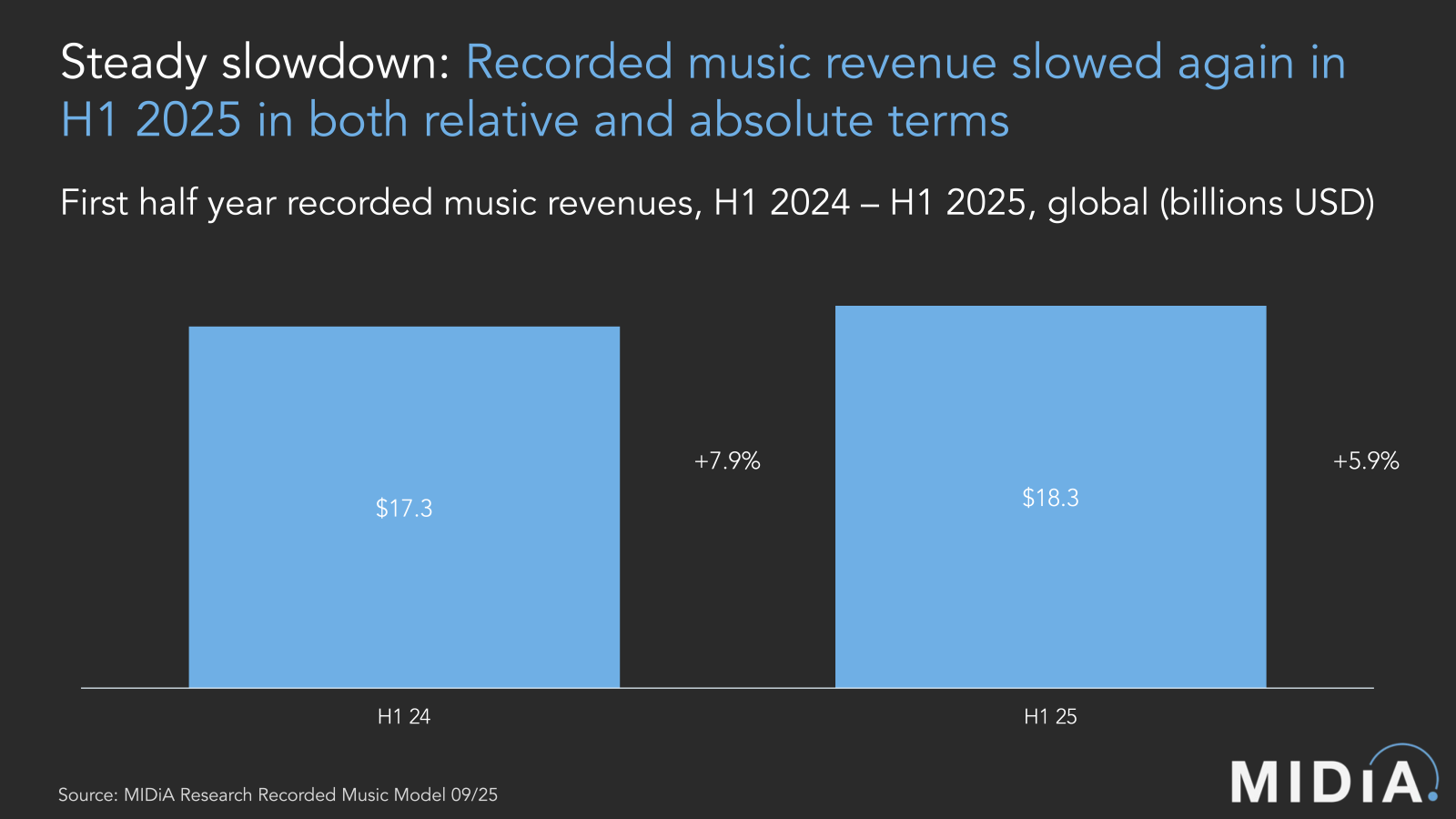

Global recorded music revenues up 5.9% in H1 2025

MIDiA is excited to announce our first ever mid-year recorded music model. Clients can access the data here, which is published as part of our H1 2025 music industry metrics report, containing more than 40 pages of market metrics, company financials, and consumer data. Here are a few of the key takeaways.

Global recorded music revenues, inclusive of expanded rights, grew to $18.3 billion in the first half of 2025, with streaming continuing to increase its share of revenues. While this was an impressive mid-year milestone, market growth is slowing, with H1 2025’s 5.9% growth slower than in the first halves of both 2023 and 2024. Significantly, growth not only slowed in percentage terms, the absolute amount of revenue added was also smaller.

Beyond just recorded music, revenues grew across the vast majority of the fifteen leading, music industry companies that MIDiA tracks, covering labels, publishers, DSPs, and live. The combined revenue of these companies may have grown more slowly in H1 2025, for the fourth successive year no less, but this obscures the fact that some areas of the music business are enjoying significantly stronger growth than others, namely music publishers and DSPs.

While live music revenue growth slowed since its post-pandemic bounce-back period, both the music publishers and DSPs that MIDiA tracked saw their half-year growth rates increase between H1 2023 to H1 2025. The DSPs were the fastest-growing part of the music industry in H1 2025 and perhaps most significantly, they added more than twice the revenue added by the rights companies tracked by MIDiA. A major swing since the first half of 2022 when DSPs added only a third as much as the rightsholders did.

Featured Report

Ad-supported music market shares Spotify ascending

Ad-supported streaming has always occupied a unique and slightly contentious place in the music industry ecosystem. On the one hand, ad-supported still represents an effective way to reach consumers at scale, creating a wider subscriber acquisition funnel.

Find out more…Although there are various caveats and specific company-level factors at play, the overall direction of travel is of a value shift across the streaming value chain towards DSPs.

These are just a handful of the findings and insights from the 40+ page report. Clients can dive into the H1 2025 music industry metrics report here.

Not yet a MIDiA client and want to find out more? Reach out to businessdevelopment@midiaresearch.com

The discussion around this post has not yet got started, be the first to add an opinion.