Virtual concerts: A new video format

The global pandemic thrust the live music sector into chaos, with global revenues falling by 75% in 2020 compared to one year previously. The music industry was rocked by first-order impacts (no concerts, no fan engagement) and second-order impacts (many artists realising that streaming did not add up without live income alongside it). Necessity, though, is the mother of invention and an unprecedented period of innovation and experimentation followed, creating a whole new virtual concert ecosystem. One that presents great opportunity, but that also reflects the flaws of a hastily constructed industry – flaws that must be fixed for the sector to realise its ambition. Rather than the future of live, virtual concerts represent an entire new video format.

MIDiA’s new report ‘Virtual concerts: A new video format’ provides a comprehensive overview of the market with revenues, forecasts, demographics, vendor mapping and industry metrics. The report is immediately available to MIDiA clients. Here are some of the key findings.

Live streaming of concerts is not new, but the combination of a complex rights landscape and resistance from the traditional live sector stymied the sector’s growth. The fact that technology itself was not the problem is well illustrated by the dynamic growth in live streaming in other content verticals, gaming especially. Since the pandemic’s first impact, there has been a rapid rollout of new live music streaming solutions and companies, enjoying varied success both commercially and creatively. Nonetheless, artists now have a vast array of options at their disposal and the rapid shift is well illustrated by the Foo Fighters’ Dave Grohl joking during his band’s December 2020 high quality, ticketed live streamed concert that the sector had come a long way from artists playing piano in their living rooms earlier in the year.

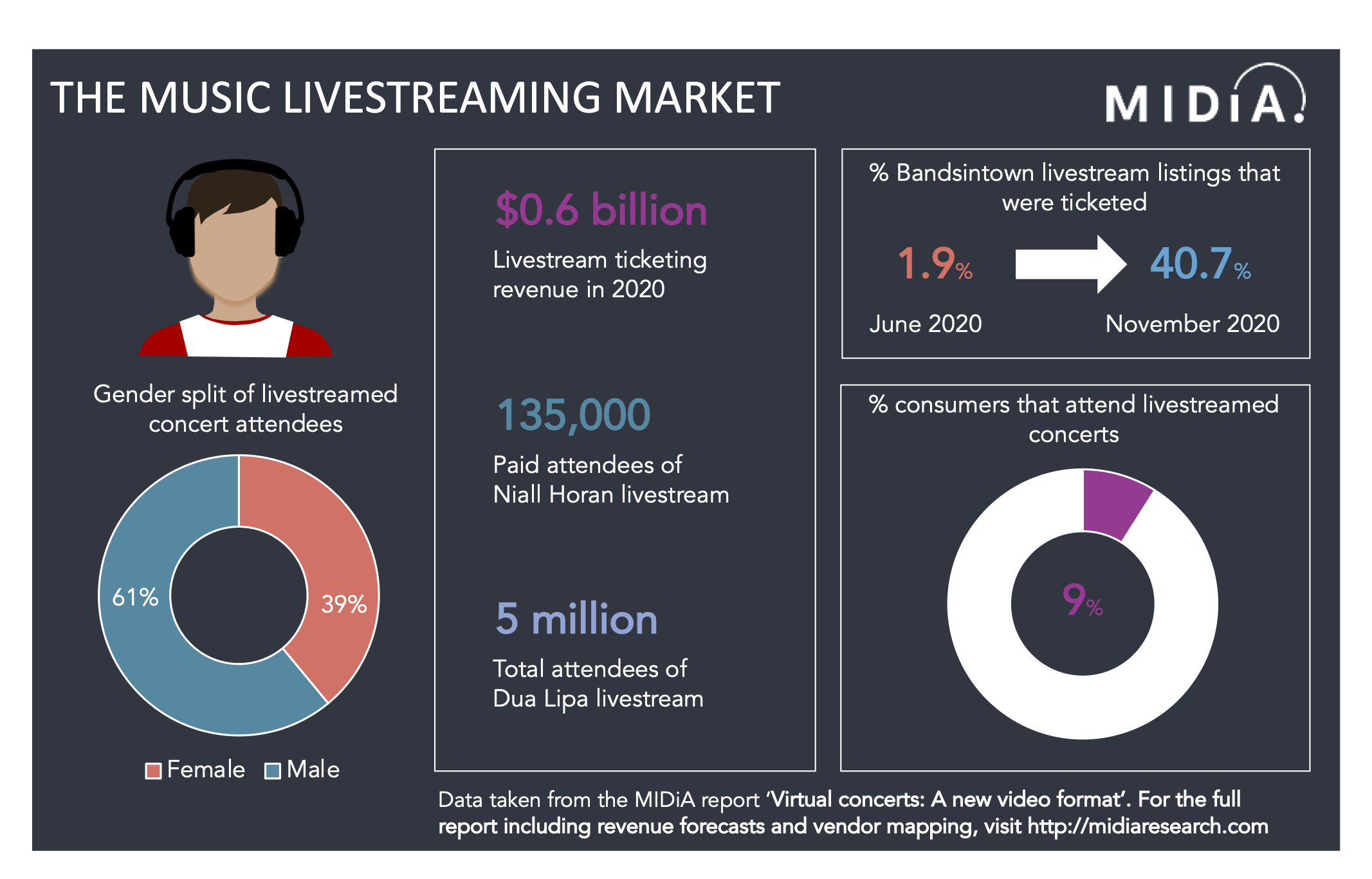

One of the most important changes was the strong shift in the latter part of the year from free streams to more professionally produced, ticketed events. From June to November 2020, the share of live-streamed concert listings on Bandsintown grew from 1.9% to 40.7%, while the total ticketed revenue in December was up 292% from June. The shift to paid is crucial, especially considering the #brokenrecord debate (arguably the most important second-order impact of the cessation of live music). Traditional live is a scarce, premium product that generates many artists the bulk of their income. Yet the start of the live streaming boom was all about free, an uncanny rerun of when music first went on the internet. With the current wave of COVID-19 worse in many countries than the first, 2021 is set to be another highly disrupted year for the live sector. It is crucial that live streaming can pick up some of the slack as a meaningful revenue driver for artists.

Featured Report

Music subscriber market shares Q3 2023 New momentum

This report presents MIDiA’s music subscriber market shares report and various MIDiA consumer surveys. All music subscriber data in this report refers to third quarters of each respective year. Numbers...

Find out more…Overall, ticketed live-streamed concerts generated $0.6 billion in 2020 with a flurry of ticketed events in the last two months of the year, including end-of-year spectaculars from heavyweights as diverse as Justin Bieber and Kiss.

Live streaming though has a long way to go, illustrated by the fact that penetration is just 9% and audiences have an early adopter, younger male skew. In many respects live streaming was not ready for primetime when COVID-19 hit. Unlike sectors such as video conferencing and home fitness tech, which had become well established before, music live streaming was a bit of an industry backwater. A whole host of new entrants swept in to tap the new opportunity, while pre-existing ones that had been limping along pre-COVID, gave themselves a new lick of paint.

The vendor landscape is complex and increasingly fragmented. But most importantly, it is characterised by companies wanting to own as much of the value chain as possible and trying to achieve as much as they can before the giants of the traditional live sector get back on their feet.

Live streaming has vast potential – not in some binary live music replacement equation, but instead as a new video format. In fact, live streaming could be to live music what pay-TV is to sports, creating in the long run a market that is even bigger than the core business. But between now and then there is a lot of hard work to be done.

There are comments on this post join the discussion.